With mass layoffs hitting Israeli high-tech hard in the past few months, it was cheering to get a rosy report on the health of its life-sciences sector at the MIXiii Health-Tech.IL Conference in Jerusalem on November 10.

The conference’s organizer, Israel Advanced Technology Industries (IATI), shared findings from its 2021 report with approximately 1,000 conference attendees from 30 countries. (“MIXiii” stands for the mix of health and tech, combined with Israel, international and innovation.)

Highlights were presented by the report’s lead author, Omer Gavish, partner in PwC Israel and head of its Pharmaceuticals & Life Sciences division.

Gavish said there are approximately 1,800 active life-sciences companies in Israel, 80 percent of them founded in the last decade.

“This is an enormous number, and it’s about the same in 2022,” he said. “The majority, more than 60%, are in early stages.”

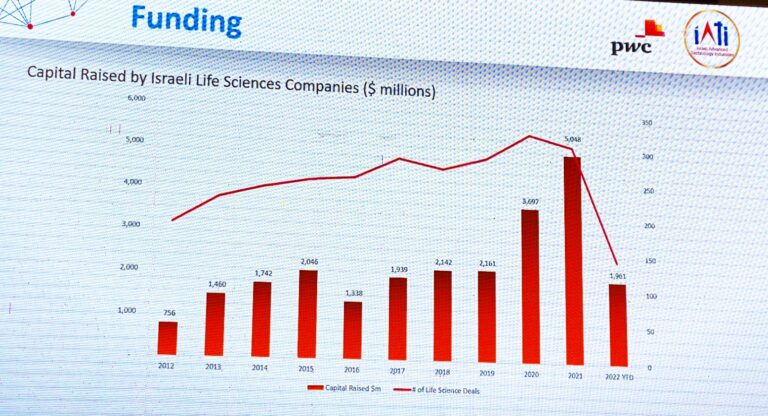

Approximately $3.8 billion of investment dollars flowed to private Israeli life-sciences companies in 2021, of which $1.5 billion was invested in the last quarter alone. Digital health companies received $1.5 billion of the total, an increase of 300% over 2020.

Foreign investment is up

Gavish noted that $1 billion came from local investors, while foreign investors doubled their investments from 2020. This trend toward foreign investment continued in the first nine months of 2022.

Among publicly traded Israeli life-sciences companies, 2021 marked the first year in which they surpassed $1 billion raised on the various US stock exchanges.

“US stock markets were, and remain, a significant source of funding for life-science companies in Israel,” Gavish said.

“Over the last decade, 21 Israeli life sciences companies raised more than $6 billion in the US stock markets, mostly on NASDAQ. Over 50% of this amount was raised in the last four years,” though the trend has slowed in 2022.

Nine life-science companies raised $209 million on the Tel Aviv Stock Exchange (TASE) in 2021, a record for the past decade.

Record year for life sciences

The approximately $5 billion invested in private and public Israeli life sciences companies represents an increase of 44% compared to 2020.

“It was another record year for the industry,” said Gavish. “This is the first year that total investment crossed the $5 billion mark, more than double than what we had in 2019, which was itself a great year.”

Average deal size also set a record of $13.7 million per deal. TASE-listed life-sciences companies saw an average deal size of approximately $23 million, the highest in the last decade.

“As we predicted last year, the increase in investments – which started with the Covid-19 pandemic period and continued throughout most of 2021 — was mostly in digital health and medical device subsectors,” he said.

Gavish said that approximately $1.7 billion was invested in life-science companies in the first nine months of 2022.

“This amount is higher than most years in the last decade despite a decrease compared to the corresponding period in 2021.”

However, he added, “By the end of 2021 we experienced a decline in the capital markets. This trend continues in 2022 and affected not only the number of public investments, but also the total investments in life science companies.”

Exports thriving

Exports of Israeli life-sciences products are thriving, reported Gavish. These products are mainly medical devices and pharmaceuticals.

Total pharmaceutical exports in 2021 equaled $2.1 billion, an increase of 23% compared to 2020. Total medical device exports added up to $3.1 billion in 2021, approximately 20% more than in 2020.

According to figures for the first half of 2022, it seems that the increase will continue.

Pharma exports during that first half totaled $1.5 billion, an increase of 50% compared to the corresponding period in 2021; and medical device exports totaled $1.6 billion compared to $1.5 billion in the corresponding six months in 2021.

Keep your eye on digital health

While the majority of Israeli life-science companies over the last decade are in medical devices, Gavish noted that “in the last two or three years, we see a constant decrease in the number of those companies, or at least their share.”

Digital health is the sector that’s growing fastest.

“This is the third year that we see an increase in the number of digital health companies, especially due to Covid-19. And you see that trend continuing this year for both established and seed companies,” said Gavish.

The digital health boom is affecting the geographic spread of Israeli life-sciences companies as well.

Device and pharma companies tend to be situated in Jerusalem, Rehovot, Ness Tziona and Haifa in proximity to hospitals, universities and research institutions such as the Weizmann Institute and the Technion.

But digital health companies are choosing the general high-tech hub in Tel Aviv.

Gavish explained that digital health companies are less connected to research institutions and hospitals; they are technology companies looking to compete outside the traditional life-sciences sphere.

Wellness emphasis on the rise

In addition to digital health, the IATI report identifies four niche sectors with significant growth potential in the coming years: wellness, food tech, climate tech and artificial intelligence (AI).

These sectors were noted for their innovation, fast growth and attraction for investors.

“I think what is interesting in a qualitative way, not necessarily a quantitative way, is that wellness and food tech are increasing,” said Gavish.

“Both of them are related to the quality of life, to being more preventive in approach and not just in not finding solutions for taking care of patients after they get sick.”

What’s the forecast?

“Even though we see that the market is not doing well in 2022, even though funding is not doing as well, there is substance in this industry and the future looks good,” said Gavish.

Data from the first half of 2022 regarding Israel’s life-sciences sector, he added, “is much better than the first half of 2021 even though the markets are not [doing] as well.”

IATI CEO & President Karin Mayer Rubinstein summarized, “In recent years, the life science and health technology industries have become major engines of growth for the Israeli economy. Our latest research highlights the need for further support and investment so that Israeli companies can continue creating significant social impact.”