In 2012, I bought a Renault Fluence Z.E., the 100-percent electric car from Israeli startup Better Place, which aimed to build the world’s first affordable all-electric vehicle. Planning started a full decade before the recent launch of the Tesla Model 3 – that company’s own affordable option – and made the most of the limited battery technology of the time, which was lucky if it could squeeze out 140 kilometers of range.

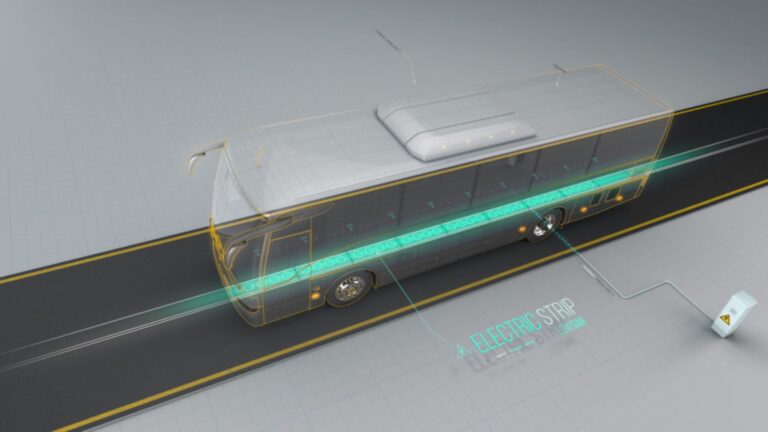

Instead of fast charge, Fluence Z.E. drivers would drive into one of 40 battery swap stations built around the country. Robots would switch out your spent battery for a fresh one in less time than it takes to fill a tank of gas.

Going electric punched all the right buttons for me: It was good for the environment, it would save us money, it was powerful and quiet, and those robotic switch stations were just so cool.

Better Place’s charismatic CEO Shai Agassi believed Better Place’s innovative technology could help stop climate change and free nations from the yoke of oil dependence. His magnetic television appearances, viral TED Talk and compelling boardroom presence had investors worldwide jumping in to ride shotgun. Countries from Japan to Denmark to Australia signed on and the privately-held Better Place raised nearly a billion dollars.

Yet in a few years, it was all over. The company, buffeted by internal strife, an international corporate spy scandal, the Great Recession and technology disruptions, went bankrupt.

In the four years since Better Place went bust, the desire to play the blame game is understandable. It was management’s fault. It was the board of directors’ fault. The price of the car was too high. The industry was consolidating around fast charge, not battery switch.

I prefer to see the glass as half full. Rather than point fingers at what went wrong, the sorry saga of Better Place reminds us of something critical about entrepreneurship in general and Israeli entrepreneurs in particular: that failure is far from the end of the journey.

“Being willing to take risks is essential,” says Saul Singer, who co-authored the best-selling book Start-up Nation with Dan Senor. Start-up Nation chronicled the story of Better Place in its very first chapter. And Singer bought a car from Better Place as soon as one was available.

The collapse of Better Place, Singer told me, is actually “a good example of how Israelis have a tolerance for failures. We don’t just hide them. We get up, brush ourselves off and do the next thing.”

Venture capitalists know that 90% of the companies they invest in won’t make it to a lucrative exit – either via an acquisition or an initial public offering. Better Place seemed like such an enormous failure in large part because it raised so much money and expectations were so high. But it was still a startup.

Another important lesson that the Better Place story emphasizes: The first company to develop a new product is often not the one that reaps the biggest rewards. (Think Betamax vs. VHS or the original Macintosh operating system vs. Microsoft Windows.)

But that’s how technology grows. The first iPhone prompted Google to build its competing Android operating system, which pushed Apple to the next generation iPhone and so on.

For electric cars, the failure of Better Place taught us that customers won’t tolerate having to switch batteries every 100 kilometers or so. They want batteries that have a range equal to conventional cars and that can be recharged as quickly as filling a tank with gasoline. (Tesla can do the former; companies like Israel’s StoreDot are working on the latter.)

Trade-offs are fine with easily upgradable software. With expensive hardware like a car – not so much.

From failure to boom

Here’s another example of how initial failure can become a long-term boon. In the early 1980s, Israel began developing the Lavi, a fighter jet meant to compete with the powerful American-built F-16. When the program was shut down in 1987, following considerable lobbying by the US, it didn’t spell the end to Israel’s defense industry.

On the contrary, the technological knowledge accumulated by the thousands of Israeli scientists and engineers who had been working on the Lavi helped kick-start Israel’s satellite program (the first Ofek satellite was launched just a year later in 1988) and contributed to the country’s subsequent high-tech boom.

“As a country, we’re more willing to take risk,” Saul Singer says. “We’re more willing to be entrepreneurs. We’re more willing to fail because we know that, without failure, there’s no success.”

Singer describes Israel as “a big solution factory. We love to tackle big problems, particularly if they seem impossible to solve. I would hope that we get even better at thinking big, and that our failures will not rein in the audacity of our best entrepreneurs.”

Nor were the investors who had lost so much money with Better Place entirely devastated.

Mike Granoff was one of the first to put money into the company. He summed up the experience of riding the electric roller coaster in a letter he sent to other investors explaining Better Place’s decision to liquidate in May 2013.

“Israel was home to the world’s first full-service network for electric cars allowing uninterrupted travel across the whole country, and history will ultimately tell the significance of that milestone. While that might be little comfort to heartbroken customers, to investors, or to the hundreds of employees who need to find other work, all of us should hold our heads high in the knowledge that we played an important role in this burgeoning revolution. As [famous short seller] Jim Chanos has said, ‘In investing you can be really right, but temporarily quite wrong.’”

Granoff concluded his letter with the ultimate message of entrepreneurship gleaned, however painfully, by the collapse of Better Place. “I am sorry we were not able to bring the company to the glorious success that it deserved,” he wrote. “But I have no regrets for having tried.”

That’s how I feel, too – despite the financial loss of having bought a car that couldn’t go the distance. It was an electrifying ride and I wouldn’t have had it any other way.

Brian Blum is a regular contributor to ISRAEL21c. His new book, TOTALED: The Billion-Dollar Crash of the Startup that Took on Big Auto, Big Oil, and the World, tells the story of what happened to electric car startup Better Place. It is available at Amazon and other online bookstores. More at www.brianblum.com