During the month of July 2018, fundraising by Israeli companies was as hot as the weather, following on the heels of an IVC Research Center report revealing that Israeli high-tech companies raised $1.61 billion in 170 deals in Q2 of 2018.

The single largest deal during that quarter was Landa Digital Printing’s $300 million, while artificial intelligence (AI) companies attracted the highest capital share among the leading verticals.

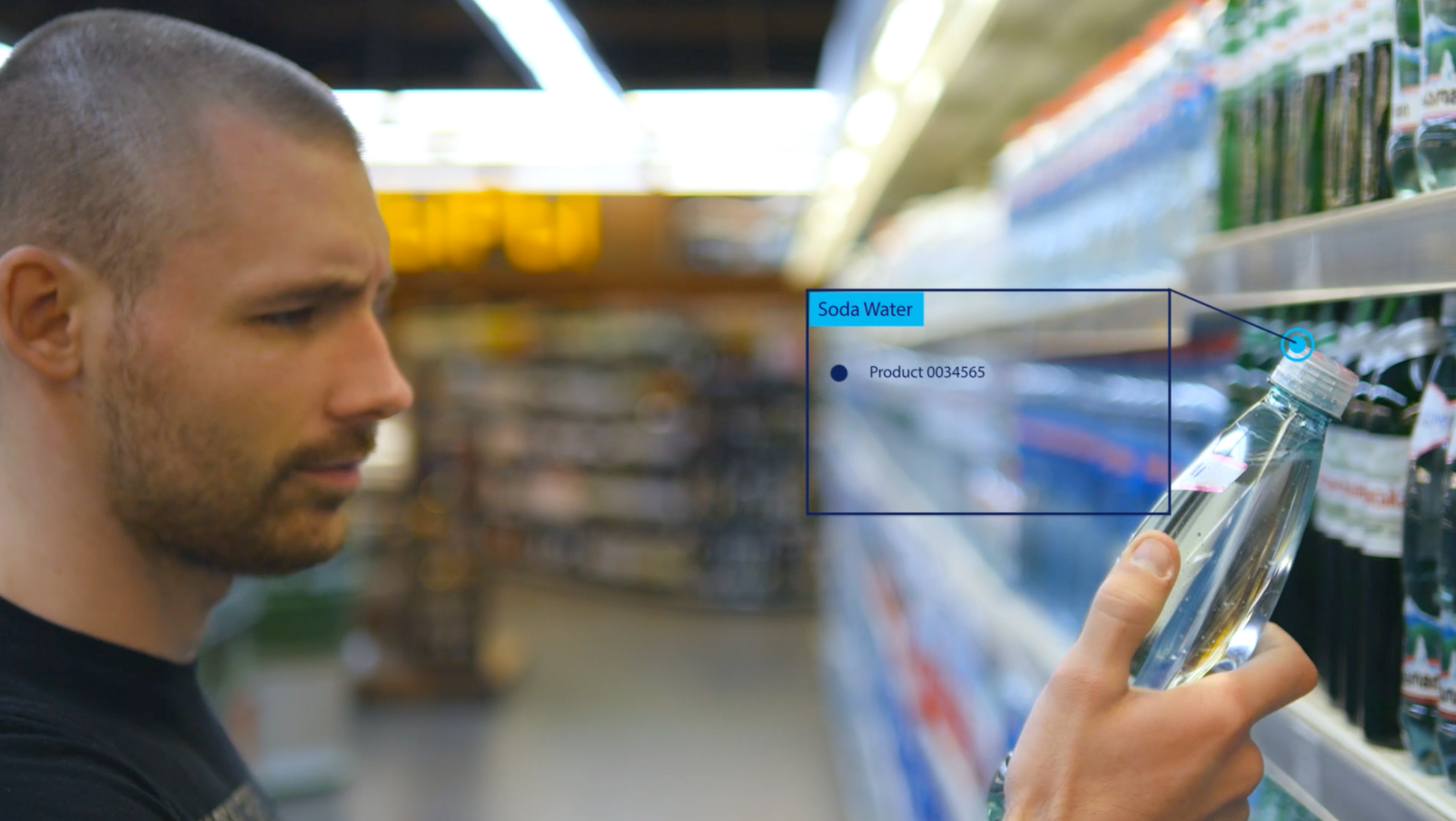

In July, Trax Image Recognition led the pack with a $125 million raise from Boyu Capital Consultancy and British production company DC Thomson. Trax provides image-recognition and computer-vision analytic tools used by retailers in some 50 countries to track inventory. The company’s research-and-development center is in Tel Aviv; headquarters are in Singapore.

Next Insurance of Kfar Saba, a fast-growing, disruptive digital insurance company for small businesses, raised $83 million in a Series B round led by Redpoint Ventures with an eye toward continued expansion throughout the United States (where it has a California office). Other investors in the round included Nationwide Insurance, Munich Re, American Express Ventures, Ribbit Capital, TLV Partners, SGVC and Zeev Ventures.

3D imaging company Mantis Vision of Petah Tikva raised $55 million from Samsung Catalyst Fund, Chinese company Luenmei Quantum and an undisclosed third investor. The company has been operating in China as part of a joint venture with Luenmei Quantum.

Tel Aviv-based monday.com, developer of a team management and communication platform for businesses, closed a $50 million Series C investment round led by New York-based Stripes Group along with existing investors Insight Venture Management and Entrée Capital.

ObserveIT insider threat-management software developer raised $33 million from NightDragon Security, Spring Lake Equity Partners and major shareholder Bain Capital Ventures. Founded in 2006 and currently headquartered in Boston, ObserveIT’s main R&D center is in Tel Aviv.

ThetaRay of Hod Hasharon completed an oversubscribed fundraising round of approximately $30 million led by OurCrowd and including Jerusalem Venture Partners (JVP), GE, Bank Hapoalim and SVB Investments. ThetaRay makes AI and big-data analytics solutions for crime prevention, operational efficiency and threat detection, with offices in New York, London and Singapore.

AnyVision of Holon secured $28 million in Series A financing led by Bosch, the German multinational technology group, with participation of two American private equity groups. AnyVision has developed proprietary AI solutions for the HLS/Police, airports, sports/entertainment, smart cities, critical infrastructure, banks, transportation and retail verticals.

BioCanCell raised $22.9 million from new and existing investors in a private placement of nearly 6 million shares and some warrants. The biopharmaceutical company, based in Jerusalem and Cambridge, Massachusetts, plans clinical trials of new therapies to treat cancer.

Viz.ai raised $21 million in Series A funding led by Kleiner Perkins Caufield & Byers. The corporate venture capital arm of Alphabet also participated. Based in San Francisco and Tel Aviv, Viz.ai develops automated analyses of CT brain scans to help doctors identify and treat strokes quickly.

Oramed Pharmaceuticals of Jerusalem sold $18.1 million of shares of common stock in a registered direct offering with several healthcare-focused institutional investors. Oramed is developing oral drug-delivery systems.

Industrial cybersecurity provider Radiflow, based in Tel Aviv with offices in the US and Europe, closed an $18 million investment round led by ST Engineering Ventures, the corporate venture capital unit of ST Engineering of Singapore. Radiflow’s existing investors, led by Zohar Zisapel, also participated.

Real-estate tech startup Skyline AI of Tel Aviv and New York raised $18 million in a Series A round from TLV Partners, Sequoia Capital, Jones Lang LaSalle IP, iAngels Crowd, Arbor Ventures and Nyca Partners.

Tel Aviv-headquartered marine data startup Windward raised $16.5 million in Series C funding led by XL Innovate with the participation of existing investors.

Cybersecurity company Siemplify (Cyarx Technologies) raised $14 million in a Series B round from Jump Capital, G20 Ventures and 83North. Based in New York with offices in Tel Aviv, Siemplify provides security orchestration, automation and response tools to enterprises.

New York- and Tel Aviv-based K Health raised $12.5 million from Mangrove Capital Partners, Lerer Hippeau, Primary Venture Partners, BoxGroup, Max Ventures, Bessemer Venture Partners and Comcast Ventures. The company is developing a crowdsourced digital health assistant to provide diagnostic information and treatment suggestions. K Health recently launched its free web and mobile app in New York.

Tel Aviv-based commercial insurance data platform startup Planck Resolution raised $12 million in a funding round led by Arbor Ventures. The same amount was raised by BlueVine Capital, with R&D in Tel Aviv, from Microsoft’s M12 venture fund and Nationwide Financial Services. This brings BlueVine’s Series E funding round, announced in June, to $72 million.

Cybersecurity startup PlainID of Tel Aviv raised $11 million in a Series A funding round from Viola Ventures, Springtide Ventures, Capri Ventures and iAngels.

Tel Aviv-based high-resolution radar startup Arbe Robotics closed a $10 million funding round led by 360 Capital Partners. Existing investors Canaan Partners Israel, iAngels, Manic Mobility, OurCrowd and O.G. Tech Ventures also participated. Medical device company Medigus of Omer also raised $10 million, in an underwritten public offering.

Fresenius Medical Care Ventures invested $2 million in the Series B financing round for Tel Aviv-based Vectorious Medical Technologies. The medical device company raised more than $10 million in this financing round, including a recent grant from the European Union’s Horizon 2020 R&D program.

Aurora Labs completed an $8.4-million Series A funding round led by Fraser McCombs Capital as well as MizMaa Ventures. Founded in 2016 and based in Tel Aviv and Munich, Aurora Labs is developing on-the-go automotive software fixes and predictive maintenance for connected vehicles.

Tel Aviv retail-tech company Trigo Vision emerged from stealth mode with the announcement of a $7 million seed funding round by Hetz Ventures and Vertex Ventures Israel. Trigo Vision’s platform combines a customizable ceiling-based camera network with machine-vision algorithms to identify and capture customers’ shopping items, eliminating the need for a checkout process.

Cloud solutions provider AllCloud of Rosh HaAyin raised $7 million from the investment arm of Israel Discount Bank, Hallett Capital, Jesselson Capital Corporation and the Weil Family.

Octopai of Rosh HaAyin raised $4.5 million in a Series A funding round from North First Ventures, iAngels Crowd, Gefen Capital Management, Moneta Seeds Management Company and Club100 Plus Communication Investments. Founded in 2015, Octopai makes a solution for managing metadata.

NewStem, a biotech spinoff of Yissum, the tech-transfer company of the Hebrew University of Jerusalem, raised $4 million in seed financing from a publicly-traded US-based company to be named NovelStem International Corp. NewStem is developing precision-medicine technology to increase chemotherapy’s effectiveness.

Nobio of Petah Tikva raised $3.6 million in Series A funding from life-sciences venture fund aMoon and oral surgeon Ole Jensen. Nobio is developing an antimicrobial additive for synthetic materials used in dental and medical devices.

PlantArcBio of Givat Hen, a biotechnology startup for the improvement of crop yield, completed a $3 million funding round from private investors and Israel Innovation Authority grants. PlantArcBio signed an agreement with the University of Wisconsin-Madison to test its drought-tolerance genes in soybean greenhouses and fields in the United States.

OrthoSpin, a portfolio company of The Trendlines Group, completed an investment round of $3 million for its smart robotic external fixation system for orthopedic treatments. Johnson & Johnson Innovation led the investment round.

Proggio of Kfar Saba raised $2 million in an investment round led by Mangrove Capital Partners. Founded in 2016, Proggio offers Projectmap, http://projectmap.solutions/ an online service for creating collaborative visual timelines for projects and managing individual tasks by a business team.

Nanomaterials company Dotz Nano of Petah Tikva and Australia raised about $1.8 million in a private placement on the Australian Securities Exchange.

Škoda Auto, a Czech subsidiary of Volkswagen, announced a $1.5 million investment in Anagog, a Tel Aviv startup whose AI driver-tracking technology is already used in more than 100 different smartphone apps. Also contributing to the investment was Škoda’s strategic partner and importer Champion Motors; the two companies cofounded the joint venture Škoda Auto DigiLab Israel in Tel Aviv at the end of 2017.

Tel Aviv-based e-commerce startup Bllush Visuals closed a $1.2 million seed round led by Moscow-based Leta Capital. Bllush’s software matches fashion and design e-commerce brands with product images sourced from user-generated photos. The same amount was raised by regenerative medicine company CollPlant of Ness Ziona, which recently received grant approval from the Israel Innovation Authority to develop rhCollagen-based bio-ink for 3D printing human tissues and organs.

Tel Aviv-based research database startup Materials.Zone raised $1 million from Sarona Ventures. Materials.Zone develops a blockchain-based online system that allows scientists, labs, and academic and industrial researchers worldwide to collaborate and share data regarding new lab-made materials.

Binah.ai received $150,000 from the new investment fund TAU Ventures as the first-place winner in the Tel Aviv University startup competition in which 70 new Israeli startups competed. Binah provides actionable answers to critical business challenges via a virtual data science platform.

Hyundai Motor Group of Seoul announced that it is investing “several million dollars” in a strategic partnership with Autotalks, a Kfar Netter-based company specializing in Vehicle to Everything (V2X) communication chipsets. Prior to this investment, Autotalks completed four funding rounds totaling more than $80 million.

Singapore-based United Overseas Bank invested an undisclosed sum in AI banking software company Personetics Technologies of Givatayim.