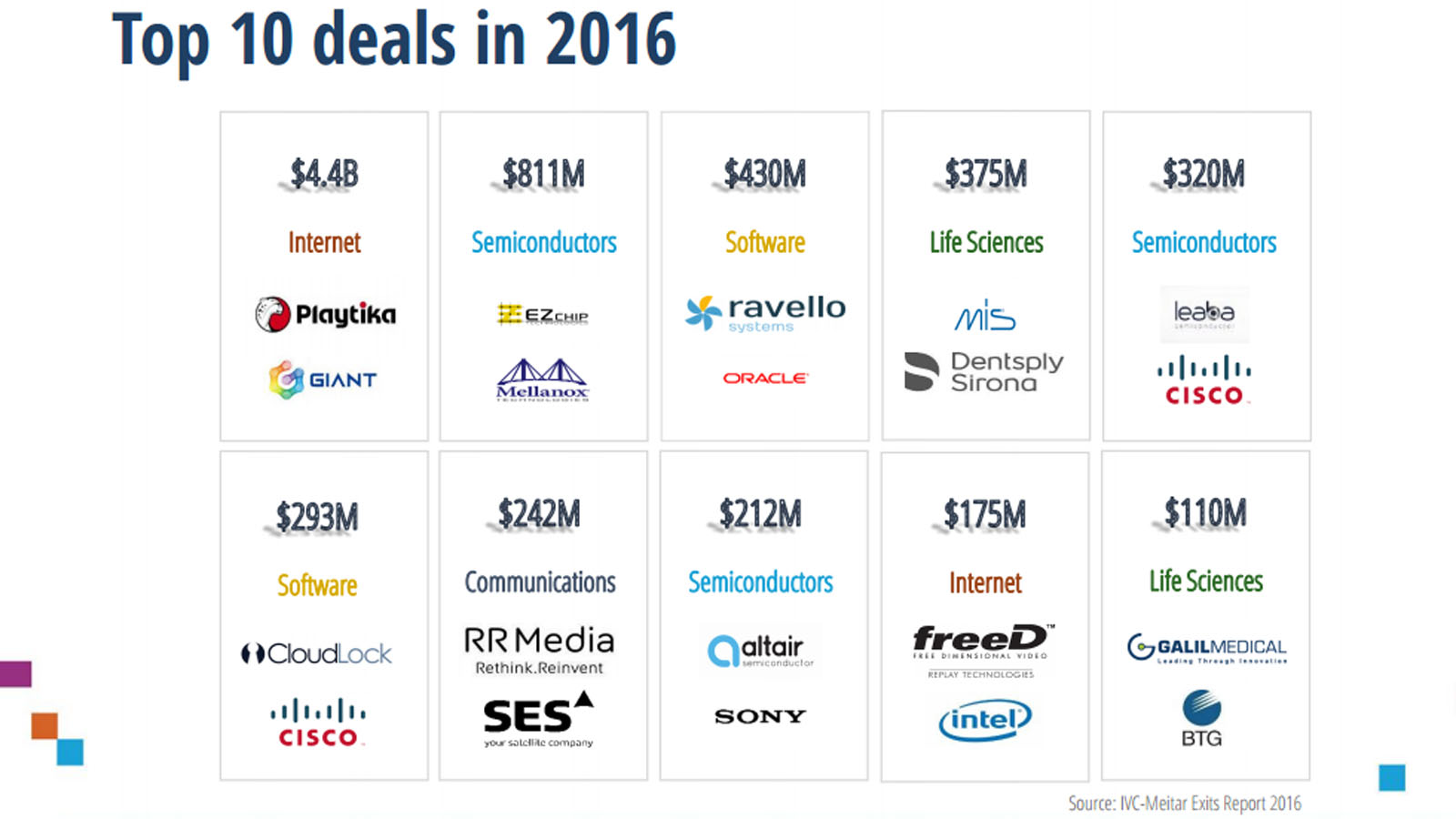

The Israeli high-tech arena posted $10 billion in exits in 2016 – including the $4.4 billion Playtika acquisition in July — according to the annual end-of-year market report by IVC-Meitar.

A breakdown of the numbers shows Israeli high-tech companies closed 104 deals – including 93 mergers and acquisitions (M&As) with a total value of nearly $8.8 billion; eight buyouts that generated $1.22 billion; and three small IPOs garnering $15.1 million, according to the IVC-Meitar High-Tech Exits Report published on January 3, 2017.

Including Giant Interactive Group’s acquisition of Israeli social games developer Playtika, overall Israeli high-tech exits in 2016 topped 2015’s $9.02 billion.

The IVC Research Center–an online provider of data and analyses on Israel’s high-tech, venture-capital and private-equity industries — reports that without the Playtika deal and the acquisition of EZchip by Mellanox for $811 million (which account for about 50 percent of total M&As and thus skew the data), 2016 actually posted fewer deals as compared to the year before.

“Following several years of growth both in terms of deal numbers and their proceeds, 2016 presents an obvious slowdown. The analysis excluding the Playtika deal yields figures that are substantially lower than in previous years. It’s impossible to tell whether this is the beginning of a new trend or a natural correction due to significant hikes in previous years. We will need to wait a few quarters to see whether or not the market is facing a profound change,” said Alon Sahar, partner at law firm Meitar Liquornik Geva Leshem Tal, which specializes in representing technology companies.

Report editors aren’t sure the drop in overall deals is a bad thing: “We believe the numbers represent a true change in the Israeli entrepreneurs’ and investors’ state of mind, preferring company growth over early acquisition.”

Koby Simana, CEO of IVC Research Center, says “2016 was by no means sub-par.”

“In fact, it proved better than the previous year in terms of the average exit multiple, and was one of the best in multiples overall. This, coupled with the relatively lower volume of deals compared to 2015, suggests to us that entrepreneurs and investors may not be pushing for exits as they once did. Instead, it seems investors are looking closely into other alternatives. An opportunity to sell requires positive returns and substantial multiples, otherwise companies and investors choose to wait patiently, opting for company growth,” says Simana.

Indeed, without Playtika, the IVC analysis shows 2016 numbers were similar to 2012’s $4.76 billion in 92 deals and was far above 2008-2010’s average $2.65 billion in 86 deals.

Ethosia CEO Eyal Solomon, whose high-tech human-resources company also produces an end-of-year market report, echoes that 2016 was a good year overall in Israeli tech despite world predicaments.

“The year began with a strong push from 2015, which was a fantastic year for high-tech,” says Solomon. “As the year progressed, and in the wake of the uncertainty created by Brexit, the US elections and the concern of investors regarding what is happening in the stock market, some global companies scuffled along and even stopped investing. However, towards the end of the year, we saw that these events did not affect long-term stock exchanges – and the market returned to being zealous, with a rally of funding.”

Buying blue-and-white to further growth

In 2016, Israeli companies buying other Israeli companies proved to be a hot trend, accounting for 27% of M&As.

In general, Internet companies led exits in 2016, according to the IVC-Meitar report, with 55% of total exits and more than twice the sector’s average in the past five years.

Semiconductors followed with 16% of the exits amount, with three deals exceeding $200 million each – Mellanox’s acquisition of EZchip ($811 million), Cisco’s acquisition of Leaba ($320 million) and Sony’s acquisition of Altair ($212 million).

Nearly 50 other Israeli companies made at least one M&A deal in 2016, either in Israel or abroad, according to the report.

Amdocs, ironSource, Somoto and SuperCom each made two Israeli acquisitions in 2016.

Overall, M&A expenditures by Israeli companies hit an all-time record of $3.28 billion, in addition to over $45 billion in M&A deals made by Teva Pharmaceuticals in 2016.

Cybersecurity, semiconductors, automotive tech and more

For the first time, the IVC-Meitar report categorizes Israeli high-tech exits by sector to show where the local ecosystem is strongest.The report highlights cybersecurity, advertising technology and automotive technologies as the country’s most prominent segments.

There are over 450 cybersecurity companies,420 ad-tech companies and 260 automotive tech companies operating in Israel today.

While capital-raising for cybersecurity reached a record number in 2016– nearly $700 million — the number of exit deals and their proceeds have dropped.

Fourteen Israeli cybersecurity exits were closed in 2016, garnering a total of $662 million, a sharp 48% drop, compared to 2015’s $1.27 billion in 20 deals, according to the IVC report.

The largest cyber exit in 2016 was the $293 million acquisition of CloudLock by Cisco, slightly below 2015’s Adallom acquisition by Microsoft, which closed at $320 million.

“The fact the cluster continues to generate superb returns, and the obvious interest from investors – including growth rounds and late-stage capital – means companies are not pressured to make exits, and that deals are closed only when they benefit both investors and entrepreneurs. With over 450 active Israeli cybersecurity companies today, this sector is likely to continue to expand, while producing individual exits,” reads the IVC-Meitar report.

According to the IVC-Online Database, in the past three years, 35 ad-tech companies have been acquired or merged, five held IPOs (four in 2014) and one was acquired in a buyout, resulting in a total of $1.89 billion in exits.

The largest deals during that period include the $200 million acquisition of Exelate by Nielsen and the $150 million acquisition of SuperSonic by ironSource, both in 2015.

Israel’s automotive sector is led by Mobileye, which logged both the largest buyout deal of $400 million in 2013 and the largest IPO, generating over $1 billion in 2014 while its market cap nearly doubled since.

In 2016, six exit deals garnered a total of $205 million in the automotive cluster. The largest was Harman’s $75 million buyout of TowerSec.

Ethosia’s report concurs that Israel’s automotive technologies are likely to shine in 2017, alongside new disruptive tech for more traditional sectors.

“We believe 2017 will be characterized by extensive capital-raising and that the market will return to a ‘boiling’ point because of the developing of new technologies as well as a new increase in demand from ‘traditional’ companies in the banking, automotive, insurance, and many other sectors,” says Ethosia’s Solomon.