In August 2018, an e-biker struck and fatally injured a pedestrian in London. The cyclist was charged not only with causing death by careless driving, but also causing death while uninsured.

Insurance has become a big issue with the rising popularity of personal mobility vehicles and car-sharing in cities everywhere. According to CBInsights, the micromobility market in the US alone is predicted to be worth at least $200 billion by 2030.

Existing auto or homeowners’ insurance may not cover liability or medical costs if someone is involved in an accident while driving any nonstandard mode of transportation.

Tel Aviv-based Bambi Dynamic is stepping into the breach with cloud-based software that insurers and mobility service providers can use to create on-demand, personalized insurance products for this new reality.

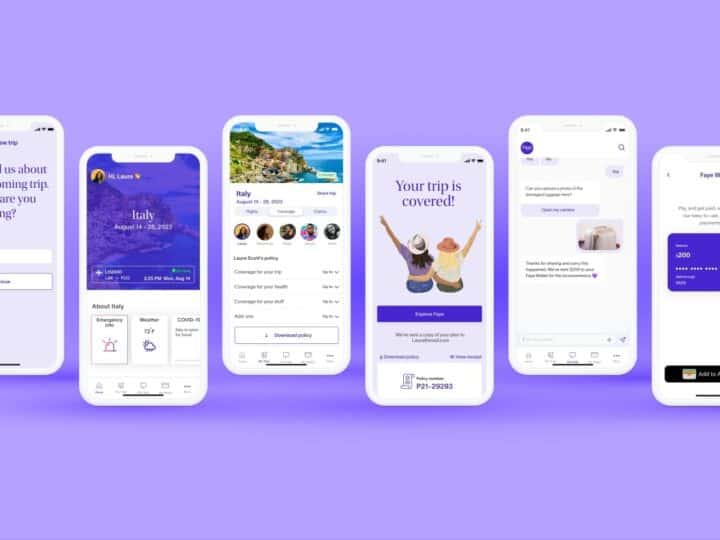

The white-label Bambi Insurance Platform (BIP) enables flexible digital policies that can be activated and deactivated as needed. Personalized premiums are based on user data including driver safety scores and time or distance driven, even for shared or multi-use vehicles.

Bambi recently raised $6 million from MS&AD Ventures, the venture capital arm of Japan’s largest insurance and financial services provider, and from The Phoenix, one of the largest insurance companies in Israel.

The first new product created under the partnership, dubbed The Phoenix Drive, is a pay-as-you-go, private vehicle insurance solution with the flexibility to replace, add or delete drivers on demand, each with adjusted premiums and individual data tracking.

Usage-based insurance

Founded in 2017, Bambi Dynamic has several advantages over other companies offering and/or enabling usage-based insurance, says CEO and co-founder Moshe Pinto.

One distinguisher is BIP’s modular format, which enables insurers and service providers to release a variety of personalized insurance policies for different transportation modes as needed, he tells ISRAEL21c.

Another is that “BIP can connect to any data source — a telematics device, connected car, ADAS [advanced driver-assistance systems] and others – or to several data sources at a time to create a wide range of existing and new customized data-driven insurance products,” Pinto explains.

These insurance products can be integrated into the IT systems of insurance companies and embedded into the apps of original equipment manufacturers and Mobility-as-a-Service (MaaS) providers of ride-sharing, ride-hailing, car-sharing, e-scooter, e-bike and delivery services.

As a white-label platform, BIP works in cooperation with data partners and offers “an easy rev-share model with our partners and customers.”

BIP also uses artificial intelligence to streamline tedious insurance processes such as underwriting, pricing and first notice of loss in claims. Its business intelligence and data science services help clients fine-tune accuracy.

Options in coverage

Third-party, comprehensive, medical and commercial coverage are among the options for policies created through BIP – like traditional insurance types, only incorporating data and connectivity for personalized coverage.

“As we are not an insurer, our platform is designed to cover any liability requested by the insurer issuing our products,” says Pinto.

“For example, in an insurance product developed for ridesharing, there is an option for the driver to change settings between personal liability coverage and a commercial one depending on their vehicular use at any given time,” he says.

“Traditional insurers are typically not able to practically and economically provide both coverage policies for the same vehicle when it is partially used for private purposes and other times for commercial purposes.”

When Bambi is connected to a ridesharing app and an insurance company, it automatically activates or deactivates insurance coverage in synch with the driver’s activation or deactivation of the ridesharing app.

“This makes the ridesharing business more economical as coverage costs correspond to on-demand usage rather than blanket fees,” says Pinto.

The future of mobility insurance

Cofounded by Pinto – who has more than 20 years of business management experience – and serial entrepreneur Zion Madmon, Bambi Dynamic has about 20 employees headquartered in Tel Aviv. Expansion is planned to serve growing markets in Asia Pacific as well as Europe and the United States.

There’s no doubt about the need for such a service as the problem of insurance for new forms of transport is evolving.

Speaking of Israel specifically, Pinto says, “There are many accidents related to micro-mobility transportation devices, especially with scooters. People using their own personal scooters are not specifically insured these days. Nor are those who do short-term rentals for the likes of Bird, Lime or Leo electric scooters.”

Last December, in response to 288 e-scooter and e-bike accidents that month alone, the Tel Aviv-Yafo municipality became the world’s first city to mandate license plates for micro-mobility vehicles for easier tracking. Two months later, a 13-year-old boy riding a Lime ride-share e-scooter in Tel Aviv was killed by a concrete mixer.

“The next phase will likely be enforcing mandatory insurance for this type of mobility service,” says Pinto.

“I presume if an accident occurs between a scooter and a car, the insurance company is involved but only pays if the car driver is at fault. In other cases, I presume, an uninsured party would need to pay.”

For more information about Bambi Dynamic, click here.