Some call it the lipstick effect. Others call it the Walmart effect or the ice-cream effect.

They describe the same phenomenon: When money is tight, we spend it on low-cost products and experiences that lift our mood without breaking the bank.

And so, while the global economic downturn is hurting many businesses, it presents a huge opportunity for others.

The lipstick effect in a slow economy, for instance, dovetails with a post-facemask makeup sales surge that is also, by the way, benefiting Walmart.

“Lipstick is once again becoming the ‘affordable luxury’ that consumers want (and can) turn to for emotional comfort,” global market tracking firm NPD Group reports.

Makeup and cheap snacks aren’t the only commodities that benefit from bad times.

We asked an academic, a venture capitalist and a cybersecurity executive in Israel which sectors stand to gain as Europe – hit by rising energy costs and inflation – heads rapidly into recession, and rising inflation also threatens recession in the United States and elsewhere.

Walmart yes, Bloomingdales no

Four industries tend to prosper in a recession, says economic policy expert Prof. Micheal Humphries, an industrial business finance and marketing lecturer at the Jerusalem College of Technology.

The first two, as we’ve mentioned, are discount or factory outlet stores and beauty salons/beauty products.

“Americans will buy less from Bloomies and more from Walmart — they will go down one rung from where they usually shop,” Humphries says.

In Israel, shoppers in the Supersol supermarket chain will drop a notch from upscale Supersol Deal or Supersol Sheli stores to the Walmart-like Supersol Extra. And they’ll choose cheaper products within a brand to which they are loyal.

The other two industries that benefit are fast-food joints (“People want to go out, but traditional restaurants will be too expensive for many”) and auto repair (“It’s cheaper to fix a car than to buy a new one”).

Humphries has another tip for entrepreneurs wanting to make money off a recession: find inexpensive ways to offer entertainment.

“People don’t want to sit at home. They’ll look for low-cost ways to pass the time, like eating from a food truck or going to a concert in a park.”

Clinical depression, home improvement

“When things go bad, companies that solve significant problems are needed,” says Ben Wiener, managing partner of Jumpspeed Ventures in Jerusalem.

Startups that solve problems “tend to be better insulated, or interesting to investors, even when the markets pull back.”

During the early Covid-19 pandemic, for instance, Jumpspeed was the first investor in Genetika+, whose platform matches people with severe clinical depression to the medications most likely to help them.

“Depression skyrocketed during Covid and always gets worse in bad times,” Wiener points out.

Housetable, another Jumpspeed portfolio startup in Jerusalem, eases the process of getting home-improvement loans and monitoring the project’s progress.

“With the housing market in decline and mortgage rates up, people are deciding to invest in renovating the house they live in rather than buy a new one,” says Wiener. “We now see increasing interest in Housetable because of the direction in which mortgage rates are going.”

Another sector Wiener identifies as a greater need during an economic downturn is cybersecurity.

“This need becomes more pressing as more money is stolen and businesses and governments are affected,” he says.

Cybersecurity, the unsung hero

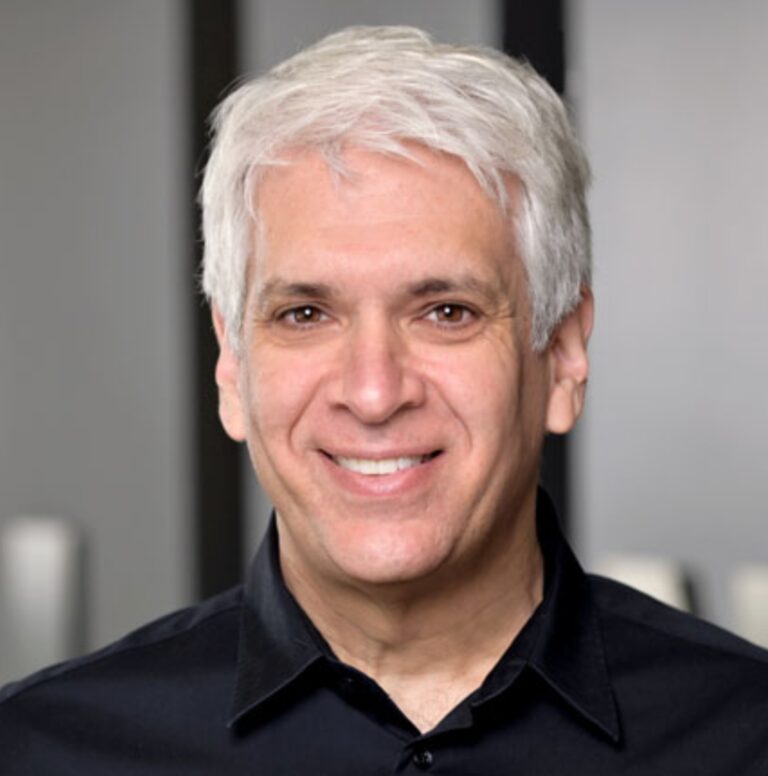

Indeed, cybersecurity companies can do well during a recession, says Ira Winkler, previously the chief security architect at Walmart and now the field chief information security officer at Israeli-based multinational cyber company CYE.

“A ransomware attack can take down an entire company and cost them countless dollars. Good cybersecurity, by preventing ransomware attacks, saves organizations money and keeps things up and running,” Winkler tells ISRAEL21c.

“Cybersecurity is really the unsung hero of what’s enabling the economy that we have, what’s enabling everything we do.”

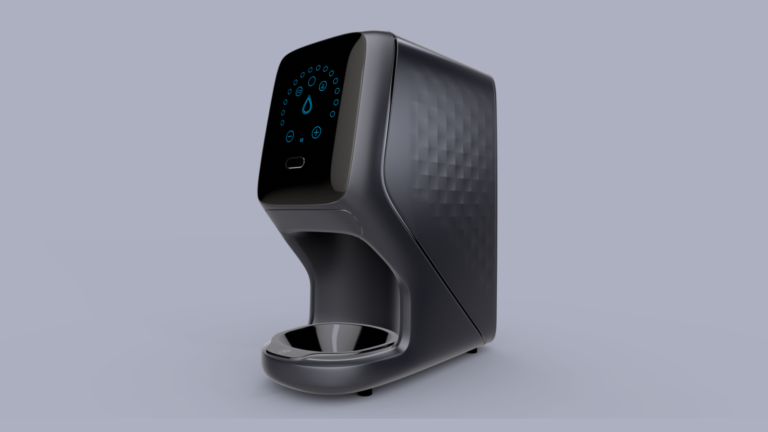

For CYE specifically, corporate budget cuts in today’s economy represent an opportunity for its flagship product, Hyver, which helps companies “identify how they’re going to save money and make the best use of whatever cybersecurity resources they have,” says Winkler.

It won’t last long

Humphries assures us that if a recession does hit the United States – which would likely lead to a recession in Israel and other countries due to rising interest rates and demand for the dollar – it won’t last long.

“Recessions tend to last no more than a year,” he tells ISRAEL21c.

“They used to last six or seven years, but since World War II they’ve never lasted more than 18 months because economists have learned how to manipulate interest rates and government budgets to get us out.”