An Israeli fintech startup is on a mission to make banking and financial activities easier and cheaper for migrant workers in a foreign country.

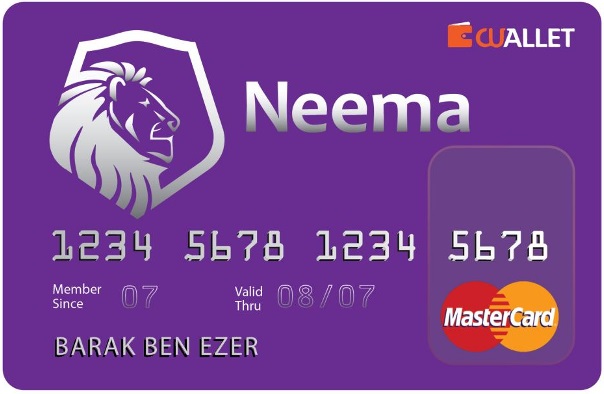

Neema, in collaboration with MasterCard, has launched a debit card that dramatically reduces the cost migrant workers pay to send money home since there are no transfer or foreign currency exchange rate fees.

“Our customers need to be able deposit cash into their account without standing in line. They also need to be able to send money to cash pick up points worldwide, a service that traditional banks do not provide. Overseas workers want to use a debit card for online and offline shopping, bill payment and ATM withdrawal- just like everyone else,” write co-founders Barak Ben Ezer and Asi Sivan in the company’s mission statement.

Ben Ezer is an entrepreneur with a background in technology and finance. He is a graduate of the Intelligence Corps and is a former project manager of Microsoft’s mobile division. Co-founder Sivan has vast experience in retail having established a network of shops and restaurants in Canada and the United States.

At present, Neema is available to migrant workers from the Philippines, India, Nepal and Sri Lanka who are working in Israel. The company says it is in the process of expanding internationally to Europe or the US, depending on the next funding round.

Neema says it offers customers the ability to deposit cash in hundreds of locations across Israel and to send money to more than 100,000 cash pickup points worldwide.

The Neema card is actually two cards – one is kept by the foreign worker in the country of employment and one is sent to a family member back home. Using Neema’s mobile app, the cards can then be connected to a joint account that allows the worker to monitor the funds, load money into the account, let the family withdraw money, and for online purchases.

Cost of this service is $10 per month.

Fighting for Israel's truth

We cover what makes life in Israel so special — it's people. A non-profit organization, ISRAEL21c's team of journalists are committed to telling stories that humanize Israelis and show their positive impact on our world. You can bring these stories to life by making a donation of $6/month.