Making money management easier is what the more than 500 fintech startups in Israel are built for. And CEOs of these companies say their products are especially useful during these uncertain economic times.

Soaring inflation is still in the headlines, with the consumer price index in the UK rising to a new 40-year high of 10.1% annually in July.

Governments are acting to counter the high cost of living, including in the United States with President Joe Biden signing the Inflation Reduction Act into law.

In June, stocks entered bear market territory amid inflation concerns.

Limiting currency exposure

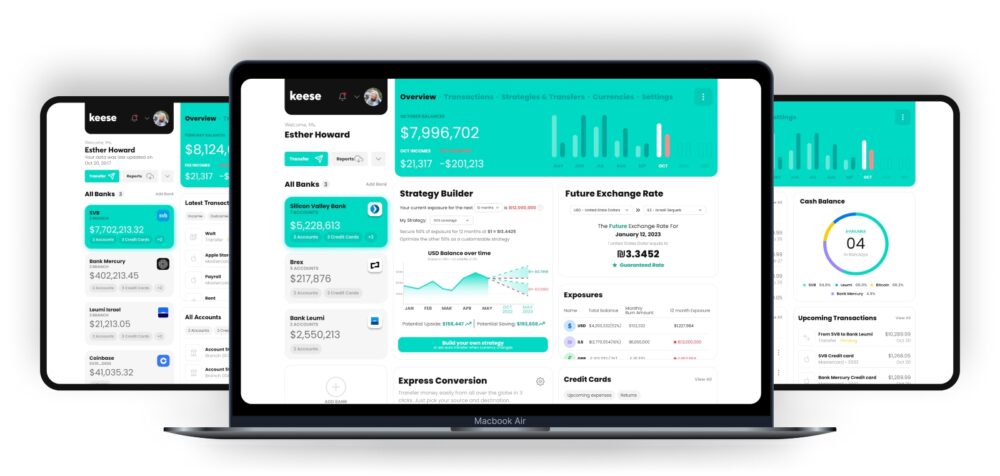

“We provide stability for companies in a time of general world turbulence,” says Daniel Rubin, founder and CEO of Keese Finance, which helps global firms manage their currency exposure.

Keese (“pocket” in Hebrew) started by assisting internationals living in Israel with multiple bank accounts, but in February the Tel Aviv-based startup decided to work with companies to limit their currency exposure – prompted by the strong shekel hitting a 26-year high against the US dollar last November.

Companies can manage and strategize their currency exposure via an online dashboard – locking in an exchange rate that is guaranteed up to one year. Keese integrates with over 11,000 banks worldwide.

“Today, for a company to budget with arbitrary exchange rates to me is extremely irresponsible and outdated. It’s just a super high-risk environment that companies shouldn’t be playing around with,” Rubin says.

“What they should be doing is locking in their exchange rate for the next year and be able to budget that and not have to think about it ever again.”

Seeing the bigger picture

Zooming out can be the best antidote for anxious investors riding Wall Street’s recent roller coaster, Gabriel Bilczyk explains.

The cofounder and chairman of Claritus emphasizes the importance of seeing the bigger picture of your investment portfolio. His personal wealth management company consolidates assets and investments in one place.

“In times like this Claritus is even more important because when everything goes fine, people say, ‘My returns are okay, I’m not very worried about my asset allocation,’” Bilczyk tells ISRAEL21c.

“But when times are shaky – when inflation raises, when the stock market is rocking, then I think it is even more important for people to be able to observe their wealth easily and on the spot.”

The Claritus platform can provide crucial context, providing key information about the overall portfolio so the investor can make more informed decisions.

“It puts me in a better place to make better decisions because my portfolio might be currently down 20% but since its inception, I’m 40% up. Then I can say that it’s not so bad and I can be less stressed with the situation. Many people are stressed because they are in the ‘don’t know’ area,” Bilczyk says.

Making smart investment decisions

Tel Aviv-based TipRanks aims to empower everyday investors by simplifying complex data, climbing to the top with its core product listing the best financial experts – raising $77 million of Series B funding in April 2021.

“We are trying to level the playing field for retail investors by making all this information available to them so they have the same level of information that an asset manager will have,” cofounder and CEO Uri Gruenbaum tells ISRAEL21c.

After 13 years of a bull market, Gruenbaum observed a change in the ranking of Wall Street analysts during the current stock market turmoil.

“Superstar analysts — usually those that cover technology — took a big hit in their rankings so we actually saw some turnover on our top expert page,” says Gruenbaum.

“Suddenly, a lot of more cautious analysts that weren’t giving crazy price targets and very optimistic forecasts are more popular on our platform.”

Last year, TipRanks added two new innovative tools: risk analysis and website traffic analysis.

The risk analysis feature identifies six risk categories for stock research so that investors can make more informed decisions. The website traffic chart shows the amount of people that visit a company’s website and the correlation with the stock price.

“It is a good way to cheat the system by getting the information from the outside before a company reports and make better investment decisions,” Gruenbaum says of the new website traffic analysis feature.

Going digital

Kobi Ram is on a mission to replace checks, credit cards and cash with paperless money transfers.

The CEO of V-CHECK cites the massive amount of paper check usage in Israel – 84 million transactions annually worth 800 billion shekels ($246 billion).

The startup was founded in 2015 to assist small and medium-sized enterprises and also large businesses to digitize the payment process at the end of the month.

Through the platform, the payment can be conducted immediately or deferred and a contract is created between the two sides.

The line of credit for these small and medium-sized businesses is not affected, Ram emphasizes.

“We do see a lot of increase in our activities right now because a lot of people are looking for options instead of charging the debit card or affecting their line of credit,” he tells ISRAEL21c.

Digital payment collections are made easier with the V-CHECK platform, which includes due date reminders and the ability to see transactions in real-time.

“We create a clearer situation for the clients,” Ram says. “They can see all the transactions in one place.”

Ram also has some advice for business owners and individuals amid inflationary concerns: Make a long-term plan for at least the next couple of years that includes reducing costs.

“See how much was gained from revenues and build your budget accordingly. Do not expect to live on a line of credit. It can be very expensive for the next couple of years. Money will be expensive, and you need to budget by what you gain.”