The amount of investment reported during April 2019 by Israeli startups reached nearly $750 million, an impressive sum especially in a month when business slowed to a crawl during the week-long Passover holiday. This puts a rosy glow on the first four months of 2019, with some $2.3 billion raised according to Israeli financial daily Globes.

Below are the top 12 funding rounds reported by Israeli companies during April 2019.

1. Selina, the Israeli-founded network of 46 hostels and coworking spaces in 13 Latin American countries, completed a $100 million Series C financing round led by New York-based Access Industries with participation from Grupo Wiese and Colony Latam Partners. Founded in Panama, Selina has a research and development center in Tel Aviv and plans to open additional sites in countries including Israel.

2. IoT security company Armis completed a $65 million funding round led by Sequoia Capital, with participation from Insight Venture Partners and Intermountain Ventures. Armis provides information security software for enterprise IoT systems and is headquartered in Palo Alto, California, with an office in Tel Aviv.

3. Aqua Security of Ramat Gan closed a $62 million Series C round led by Insight Partners with participation of existing investors Lightspeed Venture Partners, M12 (Microsoft’s venture fund), TLV Partners and Shlomo Kramer. Aqua, with offices in Massachusetts and California, specializes in protecting container-based, serverless and cloud native applications.

4. New Era Capital Partners of Boston and Tel Aviv raised $60 million for a new fund that will invest in early revenue-stage technology startups as they reach global markets. New Era claims to be the first venture capital fund in Israel to assess companies according to ESG (environmental, social and governance) responsible investment criteria for their potential to have a positive impact on the environment, society or humanity.

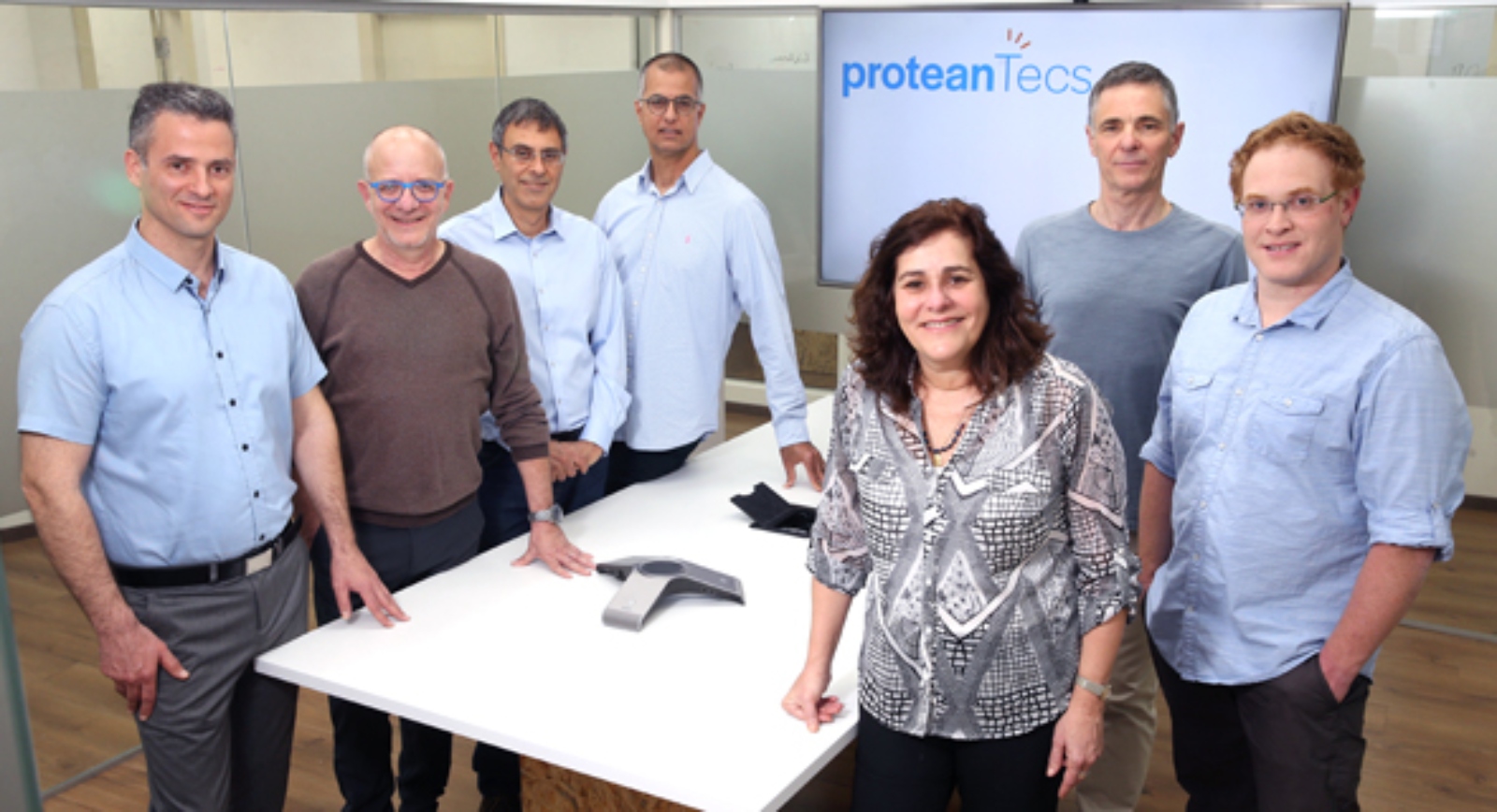

5. ProteanTecs of Haifa emerged from stealth mode with the completion of a $35 million Series B investment round involving Intel Capital, Mitsubishi UFJ Capital, WRVI Capital, Israeli entrepreneur Avigdor Willenz, ITI Venture Capital Partners, Redline Capital Management and Viola Ventures. Founded in 2017 by Shai Cohen, Evelyn Landman, Roni Ashuri, Yahel David, Eyal Fayneh and Yuval Bonen, ProteanTecs’ product helps predict failures in electronic systems. The company has branches in New Jersey and San Francisco.

6. Biopharma company Chiasma of Ness Ziona raised $34.5 million in a public offering on NASDAQ to fund research and development as well as clinical trials of its octreotide capsules for the treatment of acromegaly, a rare, chronic disease typically caused by a benign tumor of the pituitary gland. Founded in 2001, Chiasma has offices in Massachusetts.

7. Liquidity Capital of Bnei Brak, a division of Meitav Dash Investments, made a first close of an investment fund with $30 million. Founded in 2017, Liquidity offers financing against future revenues for companies with annual sales of more than $3 million.

8. App-based real-estate startup Reali of Tel Aviv and Silicon Valley raised $30 million in a Series B round led by Zeev Ventures and Signia Venture Partners with the participation of SGVentures. Founded in 2015, Reali has developed a mobile platform that claims to reduce the cost of residential real-estate transactions by more than 70%. It currently operates in California and is looking to expand.

9. Bizzabo completed a $27 million Series C round led by Viola Growth and Siemens AG investment arm Next47, with participation from existing investor Pilot Growth. Bizzabo, which makes corporate event-planning and managing software, was founded in 2011 and has offices in New York and Tel Aviv.

10. Tel Aviv-based Aidoc, one of Time Magazine’s 50 Genius Companies of 2018, announced a $27 million Series B investment round led by Square Peg Capital. Aidoc’s FDA- and CE-approved product, used in more than 100 medical centers, supports and enhances radiology diagnostics. The company will soon release an oncology line of products.

11. Tel Aviv-headquartered fintech startup Pagaya raised $25 million to expand into real estate, corporate credit and mortgages. Pagaya uses machine learning algorithms and big data analytics to manage institutional assets. The round was led by Oak HC/FT with participation from Viola Ventures, Clal Insurance, GF Investments, Siam Commercial Bank’s digital venture arm, and Harvey Golub, former chairman and CEO of American Express.

12. $25 million also was raised by Spot.IM of Tel Aviv and New York in a Series D round led by Insight Venture Partners with participation from Millhouse Capital, AltaIR Capital, Cerca Partners and Oracle senior vice president Jonah Goodhart. Spot.IM makes a user identity, engagement and community platform used by many digital media publishers.