Israel’s natural bath & body products chain Sabon is being acquired by French cosmetic maker Groupe Rocher at a company value of $129 million, according to reports.

Sabon launched in Tel Aviv in 1997 and has since gone on to be an international network with 175 retail locations around the world, in the United States, Israel, Italy, France, Romania, Japan, Hong Kong, Taiwan, South Korea, England, Germany, Netherlands, Spain, Dominican Republic, and Denmark.

Rocher will buy 66 percent of the Israeli company to strengthen its global reach. Rocher’s brands include Yves Rocher cosmetics and Petit Bateau underwear.

All Sabon products are manufactured and packaged in Israel and shipped worldwide.

Sabon said in a statement that it will be able “to enjoy Rocher’s internal resources and the group’s strong relationships will all support the company and maximize its opportunities for global growth. The joint objectives that have been set with our new partners cover a wide range of areas, including expanding into new markets, continued growth and opening new stores in existing markets.”

Sigal Kotler-Levi and Avi Piatok, Sabon’s founders, are to continue in their managerial roles. Rocher reportedly has an option to buy out the rest of the company later on.

Another recent buyout is California’s Avery Dennison labeling and packaging firm’s agreement to acquire Hanita, a pressure-sensitive materials manufacturer, from Kibbutz Hanita and Tene Investment Funds for $75 million.

Headquartered in Israel with sales and distribution facilities in the United States, Germany, China and Australia, Hanita develops and manufactures coated, laminated, and metalized polyester films for a range of industrial and commercial applications.

In related news, December’s chilly weather has brought some hot investments for Israeli companies.

Israeli startup Life On Air has raised $52 million for its live video chat app Houseparty, which allows large groups to participate in live chat if they are members in the chat group. The financing round was led by Sequoia Capital with participation from Aleph VC, Comcast Ventures and Greylock Partners.

Lumus, a developer of augmented reality (AR) wearable displays, recently completed a $45 million investment round with an additional $30 million in funding from top-tier strategic investors including Quanta and HTC.

Earlier this year, as part of this round, the Rehovot-based company received $15 million in financing led by Shanda Group and Crystal-Optech.

“This new funding will help Lumus continue to scale up our R&D and production in response to the growing demand from companies creating new augmented reality and mixed reality applications, including consumer electronics and smart eyeglasses,” says Lumus CEO Ben Weinberger.

BreezoMeter, a leading global air quality analytics provider, has announced the closing of $3 million in series A fundraising led by Phi Square Holdings, with Entrée Capital, Launchpad Digital Health and SeedIL.

BreezoMeter will use the funding to expand its air quality data access globally.

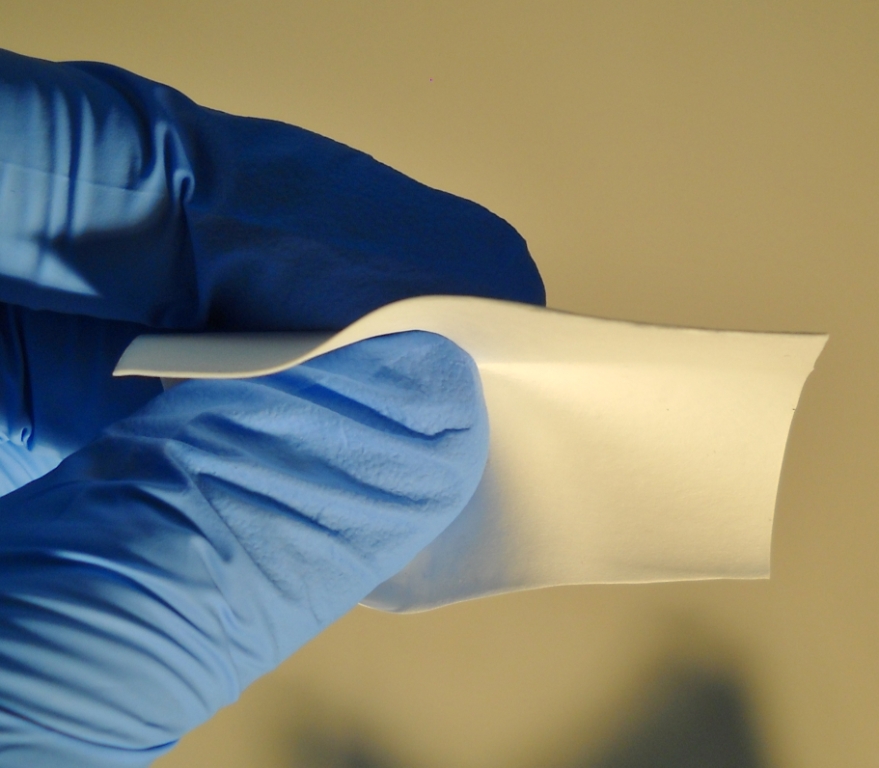

Nurami Medical, a startup in the field of tissue engineering that operates within the framework of NGT3 in Nazareth, has completed its first round of financing totaling over NIS 2.5 million, from the Alfred Mann Foundation and private investors.

Nurami Medical is developing an innovative technology platform for soft tissue replacement and repair. The first product on the market is a synthetic, biodegradable replacement for the dura mater tissue that protects the brain, for use in neurosurgery.

The new funds raised will enable preliminary clinical testing on humans during 2017, and continued development of the product.