Edwards Lifesciences, a leader in patient-focused innovations for structural heart disease and critical care monitoring based in the US, has announced that it has agreed to acquire Valtech Cardio, a privately held company based in Israel and developer of the Cardioband System for transcatheter repair of the mitral and tricuspid valves.

The deal is said to be worth up to $690 million in its first stages — $340 million in stock and cash, with the potential for an additional $350 million in pre-specified milestone-driven payments over the next 10 years.

Prior to the close of the transaction, which remains subject to customary closing conditions and is expected in early 2017, Valtech – which specializes in the development of devices for mitral and tricuspid valve repair and replacement — will spin off its early-stage transseptal mitral valve replacement technology program. Edwards retains an option to acquire that program as well and its associated intellectual property, which could then push the total acquisition closer to $1 billion.

News of the buyout comes one year after reports that US-based heart technology company HeartWare International had entered into a definitive agreement to acquire the privately held Or Yehuda company for a sum of $929 million. That acquisition eventually fell through.

Now, Irvine, California-based Edwards is reported to be the buyer of the Israeli firm.

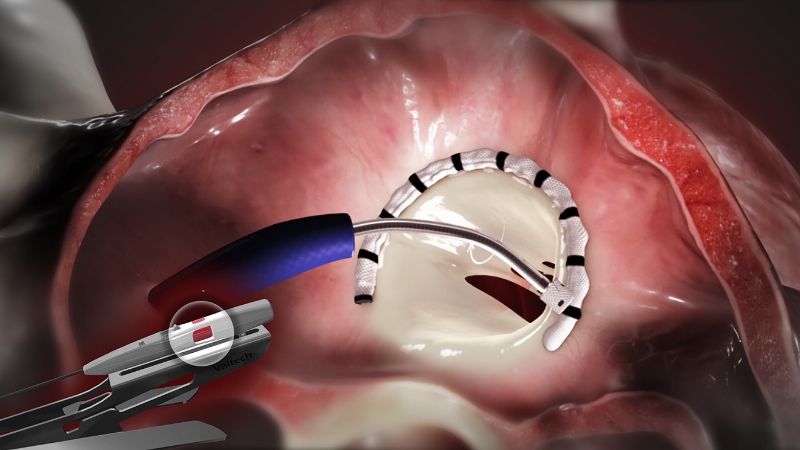

Valtech is renowned for its Cardioband System which combines a reconstruction implant, similar to a surgical annuloplasty mitral valve repair device, with a transcatheter approach. The system utilizes a catheter inserted into the femoral vein and delivered through a transseptal approach across the septum of the heart.

The direct annuloplasty system features a unique segmental deployment that conforms to each patient’s specific annular geometry, addressing the needs of patients with functional mitral regurgitation.

In 2015, the Cardioband transseptal mitral repair system received CE Mark approval for European sales. Valtech has also initiated a CE Mark trial for the tricuspid application of a similar version of this device, which is intended to reduce tricuspid regurgitation.

“As we continue to pursue multiple therapies to address the diverse needs of patients affected by heart valve disease, we saw an important opportunity to incorporate Valtech’s technologies into our comprehensive heart valve repair and replacement portfolio,” said Michael A. Mussallem, Edwards’ chairman and CEO.

“We recognize that physicians will likely need a toolbox of options to treat their patients most effectively. We are very pleased with the progress and future prospects of the multiple internal programs we have underway, and we believe the addition of Valtech’s talented team and mitral and tricuspid technologies will present even more opportunities to help patients.”

Separately, Edwards’ Board of Directors has authorized a new share repurchase program to acquire up to an additional $1 billion of the company’s outstanding common shares. Edwards also has $277 million remaining of its current $750 million share repurchase program, which was authorized in July 2014. This authorization enables the company to repurchase shares to offset the dilution of the Valtech transaction, and continue executing its share repurchase strategies.