The complex process of valuation — determining the current worth of a private startup or its securities – has been disrupted by a breakthrough cloud-based software platform from Israeli financial-tech startup AlgoValue.

Built by former PricewaterhouseCoopers valuation experts Raphael Meyara and Tsachi Hageg, AlgoValue’s SaaS (Software as a Service) platform streamlines valuation assessments (as well as audits and simulations) for the range of professionals who generate these reports: CFOs of private companies, accountants, valuation experts, venture capitalists, angel investors and lawyers.

Standard processes and tools for valuation are expensive, time-consuming and prone to error, Meyara tells ISRAEL21c.

“When we worked for PricewaterhouseCoopers, we were struck by the bitter disappointment experienced by both investors and entrepreneurs when they witnessed the painful gap between the sums they thought they would receive from a particular venture, and what they actually obtained,” Meyara says.

“As a result, we developed a breakthrough one-stop-shop cloud-based platform, which is going to change the way valuations are performed and set a new standard for valuations and related added-value services.”

Studies by AlgoValue have shown that the software has not only simplified valuations, but improved margins by as much as 80 percent, while avoiding the mistakes that occur in Excel-based valuations, Meyara says.

The company has enjoyed a rapid rise in usership.

“Today we have more than 100 clients using the platform and we’ve only been marketing it for a year and a half. We have significant market penetration in the US, Israel and other locations including South America,” says Meyara. “We have many of the top 100 CPA firms and accounting firms in the US using our product.”

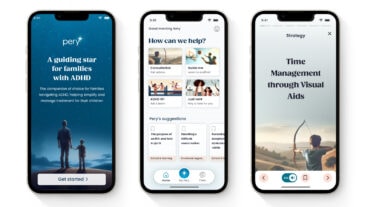

The user-friendly platform computes the value of stock and other securities in privately held companies, as well as the portion of value to allocate to each shareholder.

Kate Chhabra, partner and CFO of Catamount Ventures in San Francisco, reports that she began using the AlgoValue platform last year to perform quarterly valuation analysis on portfolio companies for investors, and run “return scenarios” on potential exits by those startups.

“The platform is unbelievably easy to use,” Chhabra says. “Within six easy steps I have my answers. I love that I can quickly get and make changes to the information I need 24/7 rather than having to wait for a third-party provider to provide me with the data.”

She adds that other team members can easily access the valuation for feedback or sign-off, and AlgoValue provides assistance when needed.

Everyone on the same page

Founded in 2011, AlgoValue is now raising its first funding round. Its own product is a great asset in this process, says Meyara.

“Startup founders rely on valuations when they have a new round of financing. But the economic value of a company does not reflect the true value of shares, and valuation decisions made by guessing or by inaccurate methodologies affect owners, shareholders and employees who have stock options.”

Meyara says that neither Excel nor other existing valuation solutions offer all the advantages of AlgoValue.

“Our interface is very intuitive, and we can take into account the most complex scenarios,” he says. “We are complying with all methodologies recommended by the AICPA and other authorities, and we empower users to review and share data in real time with any third party. Instead of everyone having their own desktop and pages, everyone uses the same platform with same information.”

AlgoValue’s development team includes a mathematician who performed complex calculations to transform the complications of valuation processes into a six-step flow: project description; volatility; capitalization table; shareholders’ rights; options plans and convertible debt; and valuation summary.

Users can input 20- to 30-page documents detailing different sets of legal rights in securities, and AlgoValue can identify and process only the two or three lines that affect the valuation.

Meyara also predicts that AlgoValue will be vital in secondary markets where private companies raise money.

“Today you have shareholders of startups all around the world and they all want platforms enabling them to sell their shares and get liquidity before the startup has an exit,” he explains.

“We can become the pricing tool for deals between winning buyers and sellers in this space, which today is like a jungle because there is no basis for the price. We can offer an entry point for negotiations and a way for the parties to share data to make good decisions.”

For more information, click here.