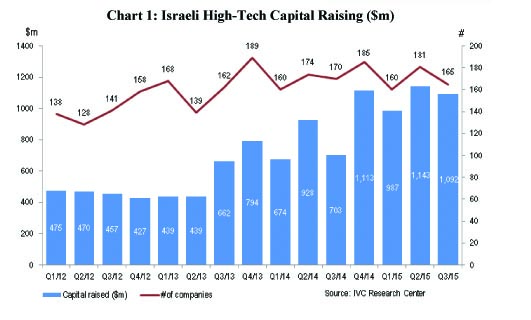

Israeli high-tech companies are likely to shatter 2014’s record-year of funding and acquisitions, according to a new survey by IVC-KPMG. The third quarter of 2015 concluded with $1.1 billion raised by 165 Israeli high-tech companies, some 55 percent above the $703 million attracted by 170 companies in the third quarter of 2014.

So far in 2015, 506 Israeli high-tech companies have raised a phenomenal $3.2 billion, reaching in nine months, nearly 95 percent of the entire 2014’s record capital raising.

Some of the biggest acquisitions this year include Heartware’s purchase of Valtech Cardio for $929 million, Amazon’s buyout of Annapurna Labs for $370 million, ClickSoftware’s price tag of $438 million, and Lumenis selling for $510 million.

“We believe 2015 may end with as much as $4.4 billion in total capital raising by high-tech companies,” said Koby Simana, CEO of IVC Research Center.

The survey is based on reports from 180 investors of which 44 were Israeli VC management companies and 136 were other entities.

Fighting for Israel's truth

We cover what makes life in Israel so special — it's people. A non-profit organization, ISRAEL21c's team of journalists are committed to telling stories that humanize Israelis and show their positive impact on our world. You can bring these stories to life by making a donation of $6/month.