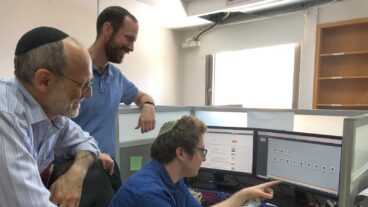

JIMF co-founder Donald Franklin hopes the new microfinancing fund will break down barriers in philanthropy.The cost of housing in Israel’s capital city Jerusalem is soaring, the disparity between rich and poor is growing wider, while the trust between Arabs and Jews remains thin.

The issue of poverty is especially dire for Jerusalem’s poorer Orthodox Jews and religious Muslims who are gearing up for major holidays at this time of the year. The Jews are already making advance preparations for the Jewish New Year in late September, while the month-long half day of fasting – and then feasting – for the Muslim holiday of Ramadan is underway.

Like in America during Thanksgiving and Christmas time, it’s easy to see in Israel how the poor suffer during holiday time. There are reports of food insecurity in the local newspapers and food banks beg for donations. Charitable acts take on a deeper meaning for those that have the means to give – and they do give. But what about the rest of the year?

In the Jewish religion, the highest form of charity is helping a person earn his or her own living. Following this age-old tradition, and merging it to complement Muslim laws in charitable giving, is a new NGO – the Jerusalem Interest-free Microfinance Fund (JIMF) – which has initiated a scheme to give interest-free loans to help Jerusalem’s poor start their own businesses.

Borrowing models from the laws in both religions – including prohibitions to accept interest-based loans – the JIMF, founded by four UK citizens, two Muslims, and two Jews, follows a worldwide trend of microfinancing, especially in the area of the environment.

Breaking barriers of suspicion

In Jerusalem, new opportunities for building businesses can break down barriers of suspicion between Israeli Arabs and Jews, reduce religious fanaticism and lead to a more prosperous city and region for all, believe JIMF founders Donald Franklin and his partner Fiyaz Mughal. They also hope it will break down barriers in philanthropy where each faith tends to support its own.

The JIMF could lead to change, since both Jews and Muslims everywhere are bound to give a percentage of their earnings to those less fortunate. It’s called “tzdaka” in Judaism and “zakat” in Islam: “We want to comply with halacha (Jewish) and sharia (Islamic) law,” says Franklin, an economist in the UK, who notes that both words come from the same root, meaning path or way.

He tells ISRAEL21c, “I was anxious to find a way of extending contact [between Islam and Judaism] which was more constructive.”

The JIMF is also advised by Jafar Sabbah, who is helping decide among other things, which of the would-be entrepreneurs in Jerusalem will receive some of the $200,000 in financing the NGO has already collected. Part of the JIMF’s service will be business training to the borrower, giving the loan extra value, while loan re-payment will be enforced by either the Jewish courts – the Beit Din – or the by the elders in the Muslim communities, depending on the recipient.

If the model works, Franklin is hoping that the JIMF can cooperate with similar micro-loan initiatives throughout the region, maybe even in the Palestinian Authority – where the Al Rafah Microfinancing Bank is set up – but unable currently to provide loans in Jerusalem, he says.